|

Investment BankingSell-Side and Buy-Side Transaction Advisory SOLIC Capital Advisors* (“SCA”) is a leader in providing comprehensive investment banking services to middle-market companies and private equity firms. With vast industry experience, as well as extensive technical expertise in all areas of financing and merger and acquisition advisory, SCA’s professionals work closely with clients to determine the optimum investment banking solution in both healthy and distressed situations. Our professionals have extensive experience advising middle-market firms across a wide spectrum of industries including Healthcare, Financial Services, Real Estate & Construction, Corporate & Industrial, and Energy. Over the past three years, SCA’s professionals have executed more than $4 billion of transactions. SCA’s transaction execution team is comprised of senior bankers with backgrounds at accounting firms, regional investment banks, major financial institutions, venture capital firms and private industry. Our senior bankers are supported by a robust group of experienced professionals with extensive transaction and operating experience. We have offices strategically located across the country. SCA provides clients with superior transaction execution by leveraging unique multi-disciplinary financial, legal, and transaction structuring experience, and extensive relationships with industry participants. Our Investment Banking team has assisted hundreds of public and private companies in executing strategic sales and purchases of companies, business units, and operating assets. Our professionals facilitate and expedite the process by advising in the formulation of strategies, identifying and screening potential buyers and sellers, performing preliminary pricing and establishing valuation criteria, and structuring and negotiating the transaction. Our commitment to client success has enabled us to continuously exceed client expectations. Capital Placements Leveraging our extensive network of relationships in the capital markets, the professionals of SOLIC Capital Advisors assist clients in securing debt and equity financing for a variety of reasons and situations, including:

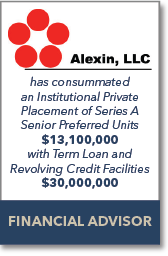

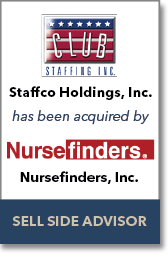

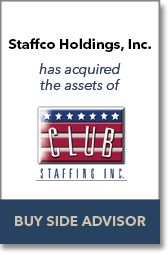

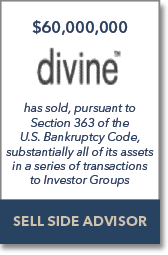

SCA facilitates and expedites a client’s financing process by performing a strategic review and assessment to formulate business objectives; determining capital needs; evaluating financing options; preparing confidential information and memoranda; identifying financing sources; evaluating proposals; and negotiating term sheets. Our market experience and industry expertise mean client capital needs are tailored to each unique situation, positioning clients to receive the optimal terms and structure given market conditions. Representative Engagements *Investment banking, private placement, merger, acquisition and divestiture services offered through SOLIC Capital, LLC. Member FINRA/SIPC. |